Decoding The PPP Wanted List: What You Need To Know

When you hear the term "PPP wanted list," it might sound like something straight outta a spy movie, but trust me, this is real life. The PPP Wanted List is not just another acronym thrown around in government circles; it's a serious deal that affects businesses and individuals alike. If you're scratching your head wondering what it even means, don't worry, you're not alone. This list is basically a compilation of entities that didn't play by the rules when it came to the Paycheck Protection Program (PPP).

Think about it like this: the PPP was created to help small businesses survive during tough times, but some folks decided to take advantage of the situation. The PPP Wanted List is Uncle Sam's way of saying, "Hey, we're keeping an eye on you." It's not just about catching bad guys; it's also about ensuring that funds meant for struggling businesses actually reach them.

Now, before we dive deep into the nitty-gritty of this list, let's get one thing straight. This isn't just some random government initiative. The PPP Wanted List is a reflection of how seriously the authorities take financial fraud. If you're a business owner or someone interested in how these programs work, you're in the right place. We're about to break it all down for you, step by step.

Read also:Valerie Bertinellis Journey Weight Love And Selfacceptance

What Exactly is the PPP Wanted List?

The PPP Wanted List is essentially a government-generated list of individuals and businesses suspected of PPP fraud. It's like a "Most Wanted" poster, but instead of bank robbers, it features those who allegedly misused PPP funds. The list is maintained by the Small Business Administration (SBA) and other federal agencies to track down and hold accountable those who exploited the program.

How Did the PPP Wanted List Come to Be?

When the PPP was first rolled out, it was a lifeline for many businesses struggling due to the pandemic. However, with great opportunity comes great temptation. Some applicants took liberties with the application process, providing false information or using the funds for purposes other than payroll. This led to the creation of the PPP Wanted List as a tool to combat such fraudulent activities.

Understanding the PPP Program

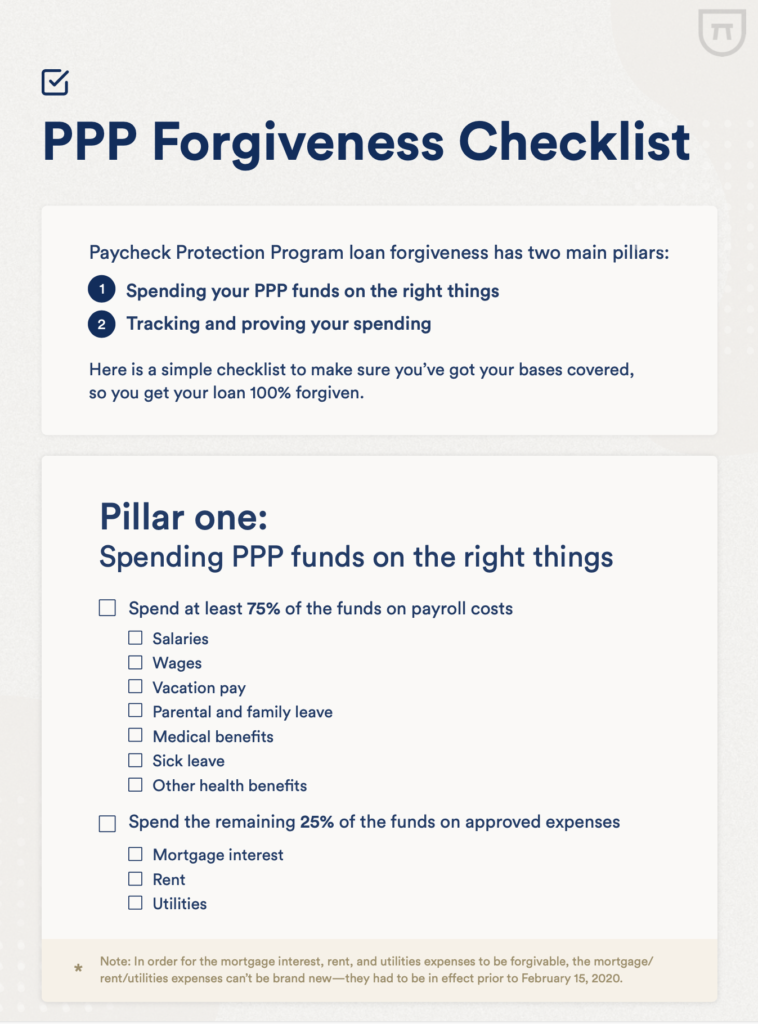

To fully grasp the significance of the PPP Wanted List, you need to understand the PPP program itself. Launched as part of the CARES Act, the PPP aimed to provide financial assistance to small businesses affected by the pandemic. Loans were offered with the possibility of forgiveness if certain conditions were met, primarily related to maintaining employee payroll.

Here's a quick rundown of the PPP program:

- Funds primarily aimed at payroll expenses.

- Loans available to small businesses and self-employed individuals.

- Potential for loan forgiveness based on specific criteria.

Who Ends Up on the PPP Wanted List?

Not just anyone can end up on the PPP Wanted List. Typically, businesses or individuals who have been flagged for suspicious activities related to PPP loans find themselves on this list. This could include submitting false information, misusing funds, or other fraudulent practices.

Examples of PPP Fraud

Let's look at some real-life examples of actions that could land someone on the PPP Wanted List:

Read also:Bridget Moynahan From Runway To Screen The Journey Of A True Star

- Claiming non-existent employees to inflate payroll figures.

- Using PPP funds for personal expenses like luxury vacations or high-end vehicles.

- Creating fake businesses to apply for multiple loans.

The Impact of Being on the PPP Wanted List

Being on the PPP Wanted List is no joke. It can lead to serious consequences, including criminal charges, hefty fines, and even jail time. Moreover, it tarnishes the reputation of the individual or business involved, making it difficult to secure future loans or business opportunities.

Legal Implications

From a legal standpoint, being on the PPP Wanted List means you're under scrutiny by federal authorities. Investigations can lead to indictments, and if found guilty, the penalties can be severe. It's crucial for anyone on this list to seek legal counsel immediately.

How is the PPP Wanted List Managed?

The management of the PPP Wanted List involves collaboration between various federal agencies, including the SBA, Department of Justice, and the FBI. These agencies work together to investigate cases of suspected fraud and update the list accordingly.

Data Collection and Analysis

Data collection plays a vital role in maintaining the PPP Wanted List. Agencies use advanced analytics to detect patterns of fraud and flag suspicious activities. This data-driven approach helps ensure that only those genuinely suspected of fraud are included on the list.

Preventing PPP Fraud

Prevention is always better than cure, and the same holds true for PPP fraud. Businesses and individuals can take several steps to avoid ending up on the PPP Wanted List:

- Ensure all information provided in PPP applications is accurate and truthful.

- Use PPP funds strictly for their intended purposes.

- Keep detailed records of how funds are utilized.

Role of Audits

Audits are a crucial mechanism for preventing and detecting PPP fraud. They provide a systematic way to verify the legitimacy of PPP applications and ensure compliance with program guidelines. Businesses should be prepared for potential audits and maintain proper documentation to facilitate the process.

Public Awareness and the PPP Wanted List

Raising public awareness about the PPP Wanted List is essential. By educating the public about the consequences of PPP fraud, authorities hope to deter potential offenders and encourage responsible behavior among applicants.

Community Involvement

Community involvement can play a significant role in combating PPP fraud. Encouraging individuals to report suspicious activities and promoting transparency in PPP applications can help maintain the integrity of the program.

Conclusion: Staying Off the PPP Wanted List

As we wrap up this deep dive into the PPP Wanted List, remember that it's all about accountability and integrity. Whether you're a business owner or just curious about how these programs work, understanding the PPP and its associated risks is crucial. By staying informed and acting responsibly, you can avoid the pitfalls that lead to the PPP Wanted List.

So, what's next? If you've learned something valuable from this article, why not share it with others? Knowledge is power, and spreading the word about the PPP Wanted List can help protect businesses and individuals from making costly mistakes. And hey, while you're at it, check out some of our other articles for more insights into the world of finance and business.

Remember, staying off the PPP Wanted List isn't just about following the rules; it's about building trust and maintaining a good reputation. Now go forth and conquer the business world, but do it the right way!

Table of Contents

- What Exactly is the PPP Wanted List?

- Understanding the PPP Program

- Who Ends Up on the PPP Wanted List?

- The Impact of Being on the PPP Wanted List

- How is the PPP Wanted List Managed?

- Preventing PPP Fraud

- Public Awareness and the PPP Wanted List

- Conclusion: Staying Off the PPP Wanted List

References:

- Small Business Administration (SBA)

- Department of Justice (DOJ)

- Federal Bureau of Investigation (FBI)

Article Recommendations