Polk County Tax Estimator: Your Ultimate Guide To Property Taxes

Let’s face it, property taxes can be a real headache. Whether you’re a homeowner in Polk County or thinking about buying property there, understanding how the Polk County tax estimator works is crucial. This powerful tool can help you plan your finances and avoid any nasty surprises when tax season rolls around. So, buckle up, because we’re diving deep into everything you need to know about Polk County tax estimator.

Now, I get it, taxes aren’t exactly the most exciting topic, but trust me, this isn’t your average dry article. We’re going to break it all down in a way that’s easy to understand, practical, and maybe even a little fun. Because let’s be honest, who doesn’t love saving money and feeling smart at the same time?

In this guide, we’ll cover everything from how the Polk County tax estimator works to some insider tips on how to lower your property tax bill. By the end of this, you’ll feel like a tax pro, ready to tackle anything the county throws your way. So, grab your coffee, and let’s get started.

Read also:Dylan Dreyers Busy Life And Her Love For Selfcare

What is the Polk County Tax Estimator?

The Polk County tax estimator is an online tool designed to help property owners calculate their estimated property taxes. It’s like having a crystal ball for your finances, giving you a pretty good idea of what you’ll owe before the official tax bill arrives. This tool takes into account factors like property value, exemptions, and tax rates to give you a personalized estimate.

But why does it matter? Well, knowing your estimated taxes can help you budget better, avoid unexpected expenses, and even plan for future property purchases. Plus, it’s free to use, so you’ve got nothing to lose and everything to gain.

Now, here’s the cool part: the Polk County tax estimator isn’t just a number-crunching machine. It’s also a great way to understand how different factors affect your tax bill. For example, did you know that adding a pool to your property could increase your taxes? Or that certain renovations might qualify you for tax breaks? We’ll dive deeper into these later, but for now, just know that this tool is your best friend when it comes to property taxes.

How Does the Polk County Tax Estimator Work?

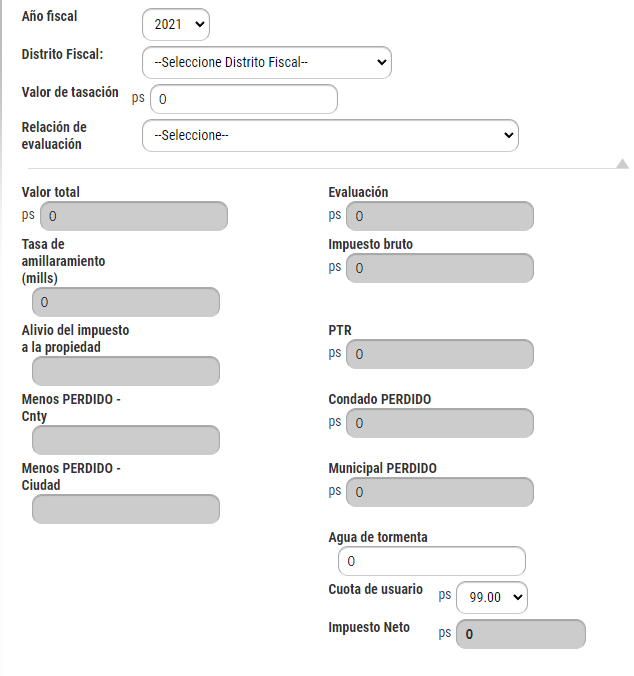

Alright, let’s talk about the nitty-gritty of how the Polk County tax estimator works. When you use the tool, you’ll need to input some basic information about your property, such as its location, size, and estimated value. The estimator then uses this data along with current tax rates and exemptions to calculate your estimated tax bill.

Here’s a quick breakdown of the process:

- Step 1: Enter your property details, including address and property type.

- Step 2: Input the assessed value of your property. This is usually provided by the county assessor’s office.

- Step 3: Select any applicable exemptions or deductions, such as homestead exemptions or senior citizen discounts.

- Step 4: Review your estimated tax amount and see how different factors impact your bill.

It’s important to note that the Polk County tax estimator provides an estimate, not a guarantee. Tax rates can change, and there might be additional fees or adjustments that aren’t accounted for in the tool. However, it’s still a great way to get a ballpark figure and stay ahead of the game.

Read also:Meet Marie Osmonds Eldest Daughter Jessica Blosil Her Life Career And Love Story

Factors Affecting Your Polk County Property Taxes

So, what exactly goes into calculating your property taxes in Polk County? There are several key factors that can influence your tax bill, and understanding them can help you make informed decisions about your property. Let’s take a closer look:

Property Value

Your property’s assessed value is one of the biggest factors in determining your taxes. This value is based on factors like location, size, and condition of your property. Keep in mind that property values can fluctuate over time, which means your tax bill could change too.

Tax Rates

Polk County sets tax rates annually based on budget needs and other factors. These rates can vary depending on where your property is located within the county, so it’s important to stay up-to-date on any changes.

Exemptions and Deductions

There are several exemptions and deductions available that can lower your tax bill. For example, the homestead exemption can reduce the taxable value of your primary residence. Other deductions might include those for veterans, seniors, or disabled individuals.

Now, here’s a fun fact: did you know that certain energy-efficient upgrades to your home might qualify for tax breaks? Things like solar panels or energy-efficient windows could save you big bucks in the long run. Who said going green has to cost you more?

Using the Polk County Tax Estimator Effectively

Alright, now that you know how the Polk County tax estimator works, let’s talk about how to use it effectively. Here are a few tips to help you get the most out of this tool:

- Double-check your property details: Make sure you’re entering accurate information to get the most accurate estimate.

- Explore different scenarios: Play around with the inputs to see how changes in property value or exemptions might affect your taxes.

- Stay informed: Keep an eye on any changes in tax rates or laws that could impact your bill.

And here’s a pro tip: if you’re in the market for a new property, use the tax estimator to compare potential tax bills for different homes. It could help you make a more informed decision and avoid any unpleasant surprises down the road.

Common Questions About Polk County Tax Estimator

Let’s address some of the most common questions people have about the Polk County tax estimator:

Is the Estimator Accurate?

While the Polk County tax estimator provides a good estimate, it’s not always 100% accurate. Tax rates can change, and there might be additional fees or adjustments that aren’t accounted for in the tool. That said, it’s still a valuable resource for getting a general idea of what you’ll owe.

Can I Use It for Commercial Properties?

Absolutely! The Polk County tax estimator can be used for both residential and commercial properties. Just make sure you’re entering the correct property type and details to get an accurate estimate.

What If I Disagree With My Tax Bill?

If you think your tax bill is incorrect, you can file an appeal with the Polk County Property Appraiser’s Office. They’ll review your case and make any necessary adjustments. It’s always a good idea to have documentation ready to support your claim.

Strategies to Lower Your Polk County Property Taxes

Let’s face it, nobody likes paying more taxes than they have to. Fortunately, there are several strategies you can use to lower your Polk County property taxes:

- Check for Errors: Make sure your property details are correct and that you’re getting all the exemptions you’re entitled to.

- Appeal Your Assessment: If you think your property is overvalued, consider filing an appeal. You might be able to get your assessed value reduced, which could lower your taxes.

- Invest in Energy Efficiency: As I mentioned earlier, certain energy-efficient upgrades can qualify for tax breaks. It’s a win-win situation!

And don’t forget, staying informed about local tax laws and changes can help you take advantage of any new opportunities to save money. Knowledge really is power when it comes to property taxes.

Data and Statistics on Polk County Property Taxes

Let’s take a look at some data and statistics to give you a better understanding of the property tax landscape in Polk County:

- Average Property Tax Rate: The average property tax rate in Polk County is around 1.1%. However, this can vary depending on where your property is located.

- Total Property Tax Revenue: In 2022, Polk County collected over $1 billion in property taxes. That’s a lot of money going towards local services and infrastructure!

- Growth Trend: Property values in Polk County have been on the rise, which means tax bills might increase as well. Staying informed about market trends can help you plan accordingly.

These numbers might seem overwhelming, but they highlight the importance of using tools like the Polk County tax estimator to stay ahead of the game.

Expert Advice on Navigating Property Taxes

When it comes to property taxes, having expert advice can make all the difference. Here are a few tips from seasoned professionals:

Stay Organized

Keep detailed records of your property details, tax bills, and any correspondence with the county. This will make it easier to spot errors or file appeals if necessary.

Consult a Tax Professional

If you’re feeling overwhelmed or unsure about anything, don’t hesitate to consult a tax professional. They can provide personalized advice and help you navigate the complexities of property taxes.

Take Advantage of Resources

Tools like the Polk County tax estimator are there to help you, so use them to your advantage. And don’t forget to check out other resources, like the county’s website or local tax office, for more information.

Conclusion: Take Control of Your Property Taxes

So there you have it, folks. The Polk County tax estimator is a powerful tool that can help you take control of your property taxes and make smarter financial decisions. By understanding how it works and using it effectively, you can avoid surprises and even save money in the long run.

Remember, knowledge is power when it comes to taxes. Stay informed, explore your options, and don’t be afraid to ask for help if you need it. And most importantly, use the Polk County tax estimator to your advantage. Your wallet will thank you!

Now, here’s your call to action: if you found this guide helpful, why not share it with your friends and family? Or leave a comment below with any questions or thoughts you might have. And don’t forget to check out our other articles for more tips and tricks on managing your finances.

Table of Contents

- What is the Polk County Tax Estimator?

- How Does the Polk County Tax Estimator Work?

- Factors Affecting Your Polk County Property Taxes

- Using the Polk County Tax Estimator Effectively

- Common Questions About Polk County Tax Estimator

- Strategies to Lower Your Polk County Property Taxes

- Data and Statistics on Polk County Property Taxes

- Expert Advice on Navigating Property Taxes

- Conclusion: Take Control of Your Property Taxes

Article Recommendations