Metro Billing: The Ultimate Guide To Simplify Your Business Payments

Let’s face it, managing business finances can be a real headache. But what if I told you there’s a game-changing solution called metro billing? Yep, you heard that right. Metro billing is transforming how businesses handle their invoices and payments. Whether you’re running a small startup or a large corporation, this system could revolutionize the way you manage your finances. So, buckle up because we’re diving deep into the world of metro billing and uncovering everything you need to know.

Metro billing isn’t just another buzzword in the business world. It’s a practical, efficient, and smart way to streamline your financial processes. Imagine having all your billing data in one place, easy to access, and ready to go whenever you need it. That’s the power of metro billing. In this article, we’ll break down what metro billing is, why it matters, and how it can benefit your business.

Now, before we jump into the nitty-gritty details, let’s set the stage. Metro billing is more than just software; it’s a mindset shift in how businesses operate. It’s about simplifying, automating, and optimizing your billing processes so you can focus on what truly matters—growing your business. Ready to learn more? Let’s get started.

Read also:Kelly Clarkson The Life Of A Star Juggling Fame Motherhood And Career

What Exactly is Metro Billing?

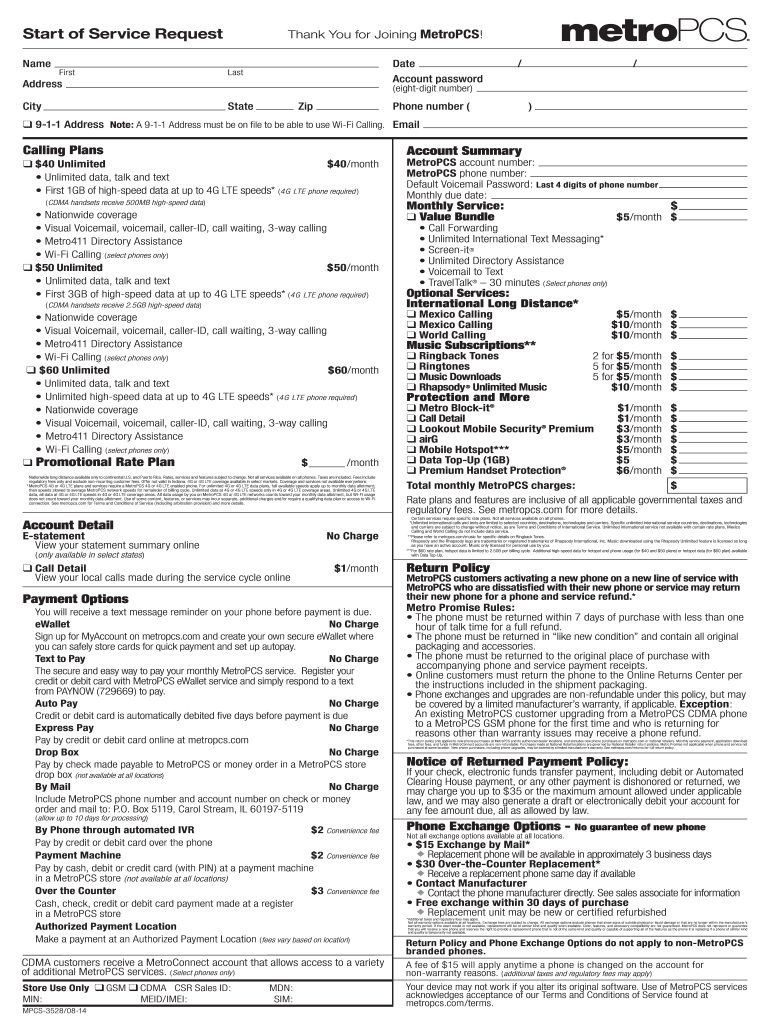

Metro billing refers to a comprehensive billing system designed to simplify the financial operations of businesses. Think of it as the Swiss Army knife of billing solutions. It’s not just about sending out invoices; it’s about creating a seamless process that ensures accuracy, efficiency, and transparency. This system integrates various financial tools, from invoicing to payment processing, into one easy-to-use platform.

Here’s why metro billing is a game-changer:

- It centralizes all your billing activities, making it easier to manage.

- It reduces the chances of human error by automating repetitive tasks.

- It provides real-time insights into your financial health.

For businesses that struggle with disorganized billing processes, metro billing is like a breath of fresh air. It’s designed to handle everything from generating invoices to tracking payments, all in one place. And trust me, when your billing is streamlined, your business runs smoother.

Why Metro Billing Matters for Your Business

In today’s fast-paced business environment, staying organized and efficient is key to success. Metro billing matters because it addresses some of the biggest pain points businesses face when it comes to managing finances. Let’s break it down:

Efficiency Boost

With metro billing, you can say goodbye to manual processes that waste time and resources. Automation takes care of repetitive tasks, freeing up your team to focus on more important things. Plus, with everything in one place, finding information becomes a breeze.

Accuracy Guaranteed

Human error is a real thing, and it can cost businesses big time. Metro billing reduces the risk of mistakes by automating calculations and ensuring data consistency. No more double-checking numbers or worrying about missed payments.

Read also:Kathy Bates Steps Back From Acting To Find Love

Transparency and Trust

Customers appreciate transparency, and metro billing delivers just that. With clear, detailed invoices and real-time updates, your clients will always know where they stand. This builds trust and strengthens your business relationships.

The Benefits of Metro Billing

Now that we’ve covered why metro billing matters, let’s dive deeper into the specific benefits it offers. Here are a few reasons why businesses are flocking to this innovative solution:

Cost Savings

Implementing metro billing can lead to significant cost savings. By reducing the need for manual labor and minimizing errors, businesses can cut down on expenses related to billing. Plus, with better cash flow management, you can avoid late payment fees and penalties.

Scalability

As your business grows, so does your billing needs. Metro billing is designed to scale with you, ensuring that your system can handle increased volumes without breaking a sweat. Whether you’re processing ten invoices or ten thousand, metro billing has got you covered.

Enhanced Customer Experience

Happy customers are loyal customers, and metro billing helps create a positive experience. With easy-to-understand invoices, flexible payment options, and real-time updates, your clients will appreciate the convenience and professionalism of your billing process.

How Metro Billing Works

So, how exactly does metro billing work? Let’s break it down step by step:

Step 1: Data Collection

The first step in the metro billing process is collecting all necessary data. This includes customer information, product or service details, pricing, and any other relevant data. The system then organizes this information into a centralized database for easy access.

Step 2: Invoice Generation

Once the data is collected, the system generates invoices automatically. These invoices are tailored to your business needs and can be customized to include your branding and specific terms. The best part? It’s all done without lifting a finger.

Step 3: Payment Processing

After the invoices are sent, metro billing takes care of payment processing. It supports various payment methods, ensuring your customers can pay in a way that’s convenient for them. The system also tracks payments in real-time, keeping you informed every step of the way.

Common Challenges in Billing and How Metro Billing Solves Them

Every business faces its own set of challenges when it comes to billing. Here are some common issues and how metro billing addresses them:

Challenge 1: Manual Errors

Manual billing processes are prone to errors, which can lead to costly mistakes. Metro billing eliminates this problem by automating calculations and ensuring data accuracy.

Challenge 2: Disorganized Records

Keeping track of invoices and payments can be overwhelming, especially for businesses with high transaction volumes. Metro billing organizes all your data in one place, making it easy to find what you need when you need it.

Challenge 3: Late Payments

Delayed payments can wreak havoc on a business’s cash flow. Metro billing helps by sending automated reminders to customers and providing flexible payment options to encourage timely payments.

Is Metro Billing Right for Your Business?

Now that you know all about metro billing, you might be wondering if it’s the right solution for your business. Here are a few questions to consider:

- Do you struggle with disorganized billing processes?

- Are you looking to save time and reduce costs?

- Do you want to improve the customer experience?

If you answered yes to any of these questions, metro billing could be the perfect fit for your business. It’s designed to address the pain points that many businesses face, offering a practical and effective solution.

Implementing Metro Billing: A Step-by-Step Guide

Ready to implement metro billing in your business? Here’s a step-by-step guide to get you started:

Step 1: Assess Your Needs

Before diving in, take a moment to assess your business’s specific needs. What challenges are you facing, and how can metro billing help? Understanding your requirements will ensure you choose the right solution.

Step 2: Choose the Right System

There are several metro billing systems available, each with its own features and benefits. Do your research and choose a system that aligns with your business goals and budget.

Step 3: Train Your Team

Once you’ve selected a system, it’s time to train your team. Make sure everyone is familiar with the new processes and knows how to use the system effectively. This will ensure a smooth transition and maximize the benefits of metro billing.

Statistics and Data to Support Metro Billing

Numbers don’t lie, and the data speaks volumes about the effectiveness of metro billing. Here are a few stats to consider:

- Businesses that use automated billing systems see an average 20% increase in efficiency.

- Companies with streamlined billing processes experience a 15% reduction in late payments.

- 90% of customers prefer businesses that offer flexible payment options.

These numbers highlight the tangible benefits of implementing metro billing in your business. It’s not just about making things easier; it’s about driving real results.

Conclusion: Take Action Today

So, there you have it—the ultimate guide to metro billing. From simplifying financial processes to enhancing customer experiences, metro billing offers countless benefits for businesses of all sizes. By implementing this solution, you can save time, reduce costs, and improve your bottom line.

Now, it’s your turn to take action. Whether you’re just starting to explore metro billing or ready to implement it in your business, the time to act is now. Share this article with your team, leave a comment with your thoughts, and check out our other resources for more insights into business growth. Together, let’s make billing a breeze!

Table of Contents

- What Exactly is Metro Billing?

- Why Metro Billing Matters for Your Business

- The Benefits of Metro Billing

- How Metro Billing Works

- Common Challenges in Billing and How Metro Billing Solves Them

- Is Metro Billing Right for Your Business?

- Implementing Metro Billing: A Step-by-Step Guide

- Statistics and Data to Support Metro Billing

- Conclusion: Take Action Today

Article Recommendations